Even Mercedes forced to reshuffle production strategy amidst global semiconductor chip shortage!

The German automaker has halted the production of its E Class lineup to boost the newly launched luxury EV, the EQS.

Computer chips halting automobile production! (Well, someone must be missing the good old analogue days). Chips are arguably the smallest part in a feature-loaded modern car but the most vital ones as they are used from onboard electronics, safety systems to infotainment consoles. (As they say, even the smallest stone makes a ripple in the water). And a modern car can easily have more than 3,000 chips (so a lot of ripples, you see).

With a major global semiconductor chip shortage, the automotive industry has been forced to re-strategise its future plans. Automakers have no choice but to prioritize the chip stocks for their most profitable and important models (Congrats Darwin, your survival of the fittest theory also works in the car world). And you know it’s serious when big boys like Mercedes are also reshuffling their production line to find a better financial optimisation.

Merc has halted production of its E Class for both sedan and wagon body styles at Daimler’s plant in Sindelfingen, Germany since early last week. However, the assembly line is expected to get back up and running again on May 14. It’s not that Mercedes lacked chips as a whole, but wants to conserve whatever stock & supply it has for three other models built there: the all-new EQS, the S-Class and the S-Class Maybach.

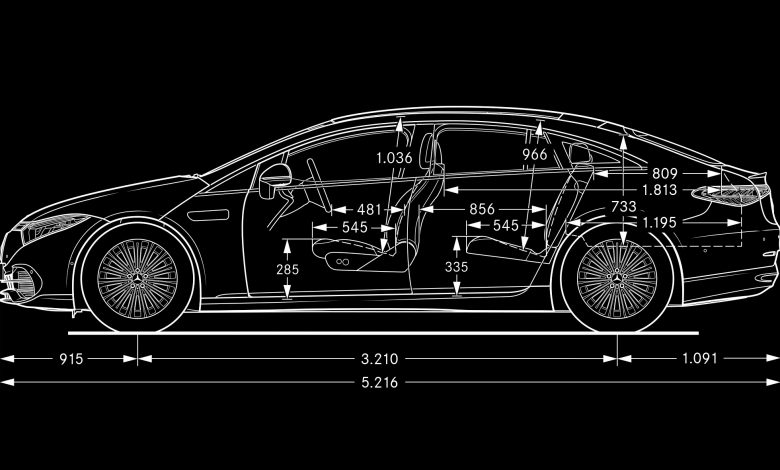

The decision to temporarily sacrifice the E-Class for the company’s new flagship electric vehicle makes total sense. Mercedes has a lot riding on its new luxury EV, the EQS and any production delays will have serious consequences. The EQS system is underpinned on an 8-core Nvidia CPU architecture which is completed by an energy GPU system that powers the user interface of the extended screen (in short, it’s a PC on wheels). The decision to keep the S-Class and S-Class Maybach assembly lines running makes sense for another important reason. They’re very profitable, probably more so than the E-Class and have a high demand in the hottest car market, China.

Overall, Mercedes isn’t struggling like General Motors, Ford, and Stellantis to keep production running at a relatively normal pace, but it’s not completely immune. Nor is its longtime rival BMW whose CEO just went on record stating he’s not overly concerned about the current situation, believing it’ll resolve within a couple of years. Merc is still managing fine for now by adopting different mitigation measures depending on the condition and market. Apart from temporarily halting production at two German plants for now, it has reportedly also shortened the working hours of up to 18500 employees.

In Australia, Mercedes-Benz is taking a totally different approach by removing the standard safety equipment in its cars due to the global semiconductor shortage. The PRE-SAFE system that prepares a car for an accident is currently not available on the Mercedes-Benz A-Class sedan & hatch, B-Class wagon, CLA sedan, GLA five-seat SUV and GLB seven-seat SUV. But to maintain the sales momentum in the Australian market, the German carmaker has also slashed the prices of such vehicles.

Toyota is the only automaker with a sufficient semiconductor chip supply on hand. The Japanese automaker learned harsh lessons after the devastating earthquake struck its homeland in 2011, and one of them was ensuring crucial components are to be kept stockpiled. Toyota bought and stored more chips than it needed for several years and that’s paying off big time right now. As for Volkswagen, it’s decided to take an entirely different approach to long-term chip supplies by designing its own.

The chip shortage is now going on for months, however, the situation was earlier anticipated to improve in the Q2. But a severe weather disruption in Texas and a fire at Japan’s Renesas Semiconductor Manufacturing Co. Ltd. has only worsened the hole in the global supply. The new expert estimation suggests the electronic scarce may continue for months to come with an uncertain recovery by Q4 of 2021. And it might get worse with the resurgence of COVID-19 which is imposing lockdowns again throughout the globe.